How to Withdraw Money from Piggyvest Safelock Before Due Date

Welcome Today we’ll be discussing on How to Withdraw Money from Piggyvest Safelock Before Due Date.

Piggyvest Safelock is a popular savings option that allows you to lock away funds for a set period of time, earning interest on the deposits. However, there may be times when you need to withdraw Safelock funds earlier than the locked date.

While Safelock is designed to restrict access until maturity, there are some methods that can allow you to withdraw funds before the due date. But early withdrawals come with a cost.

In this comprehensive guide, we provide tips and instructions for withdrawing Piggyvest Safelock funds before maturity. We also answer the top 15 frequently asked questions about early Safelock withdrawals.

Why Would Customers Want to Withdraw Before Due Dates?

Before knowing how to withdraw before maturity date, it is very important to discuss some of the reasons why customers would want to opt in for a withdrawal option before the set due date. Many of these reasons can be categorized into two (2) main categories, it include;

Unforeseen circumstances

Life is very unpredictable and in a twinkle of an eye a lot can really happen. Savers who saved using the Safelock feature on Piggyvest especially on a long term basis can have their plans cut short negating their initial plans.

Using for example, a customer who really needs to take care of a loved one in a hospital on a sickness that requires an expensive treatment.

After spending all available funds or cash at hand, and there are no more options to choose from, that particular customer won’t have an option other than to look into every other places they’d owned anything that is money or related to money and convert it to cash to sort out their problems.

A lot of other emergencies and uncontrollable situations can also come up.

Ignorance

Under this particular category, the main reason that would be discussed is the ignorance of how Piggyvest savings plans work.

Not having the proper knowledge of these features can make customers force withdrawal without knowing or having the idea of what they have done.

Like for example, a lot of customers still confuse the Safelock feature with the target savings plan. Let’s quickly talk about this in full.

How to Withdraw Money from Piggyvest Safelock before Due Date

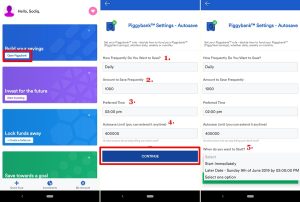

No matter your reasons for forcing withdrawals, follow this simple procedure;

Firstly log in to your Piggyvest app.

On your Piggvest dashboard, click on the “Safelock” button.

Next is to tap “Withdraw”.

Finally, you can confirm it.

Having gotten the above information from this article, it is always advisable to wait till the maturity date before making withdrawals. Once you forced the withdrawal, Piggyvest will charge 5% of the total amount of the money you’re withdrawing.

Methods to Withdraw Early From Safelock

Emergency Withdrawal

Piggyvest allows one emergency withdrawal per active Safelock before maturity without penalty. Simply login, select the Safelock, click Emergency Withdrawal, and confirm to cash out.

Partial Withdrawal

You can make a one-time partial withdrawal of up to 50% of your Safelock balance anytime before the due date. A fee of 5% of the amount withdrawn will be charged.

Full Early Termination

Terminating your Safelock early allows you to withdraw everything before maturity. However, you will forfeit all earned interest and 10% of the principal will be deducted as penalty.

Benefits of Early Piggyvest Safelock Withdrawal

Here are some potential benefits of early Piggyvest Safelock withdrawal:

- Access funds for an unexpected emergency

- Take advantage of an investment opportunity

- Cover short-term cash flow issues

- Avoid late fees on other obligations

- Fund a major life event or payment

Risks and Downsides of Early Withdrawal

Here are the key downsides to keep in mind:

- Loss of all earned Safelock interest on full termination

- 10% early termination penalty fee deducted from principal

- 5% partial withdrawal fee on up to 50% of balance

- Only one free emergency withdrawal allowed

- Defeats purpose of enforced savings discipline

Who Needs Early Piggyvest Safelock Access?

Here are some examples of when you may need to make an early Piggyvest Safelock withdrawal:

- Lost job and need funds to get by

- Family emergency like medical bills

- Opportunity to invest in a new business

- Tuition or loan payment coming due

- Want to buy a house or car sooner than planned

FAQs On How to Withdraw Money from Piggyvest Safelock Before Due Date

1. Is early Piggyvest Safelock withdrawal allowed?

Yes, you can make an emergency withdrawal or partial/full early termination, but fees may apply.

2. How many early withdrawals are permitted?

Only one free emergency withdrawal is allowed per active Safelock term. After that, partial or full termination can be done once.

3. How quickly can I access funds if I withdraw early?

Early withdrawals are processed within 24 hours on business days. The funds will reflect in your Piggyvest wallet instantly.

4. Can I withdraw everything early with no penalty?

No, full early termination results in loss of earned interest and a 10% principal deduction fee.

5. What are Piggyvest’s early withdrawal fees?

A 5% fee applies for partial withdrawal up to 50% of balance. Full termination results in a 10% principal deduction.

6. Will I lose all interest if I withdraw early?

You only lose interest if you do a full termination before maturity. Partial and emergency withdrawals allow you to keep earned interest.

7. Can I withdraw early if I have auto-renewal on?

Yes, early withdrawal is allowed before maturity even if you have auto-renewal set to roll over principal after the term.

8. How do I initiate an early withdrawal?

Log in to your Piggyvest account, go to Safelock, select withdraw, choose amount, confirm, and submit.

9. How do I cancel an active Safelock term?

Full early termination effectively cancels and closes out your current Safelock term after withdrawing the funds.

10. Can I withdraw directly to my bank account?

Early withdrawals can only be made to your Piggyvest wallet initially. You then transfer from your wallet to bank account.

11. Are partial withdrawals available?

Yes, one partial withdrawal of up to 50% of the Safelock balance can be taken before maturity, with a 5% fee applied.

12. What if I need more than the emergency withdrawal amount?

You will need to do a partial or full early termination withdrawal if you require more than the emergency amount permitted.

13. Will I get back my full principal if I withdraw early?

With a partial withdrawal you get at least 50% of your principal. Full termination results in loss of 10% of principal deposited.

14. Can I withdraw from Safelock on the maturity date itself?

On the maturity date, your Safelock funds will automatically reflect in your Piggyvest wallet. No early withdrawal action required.

15. Is there any way around Piggyvest’s early withdrawal fees?

Unfortunately no, the fees are fixed so there is no way to avoid them if withdrawing early.

Read more: finance how-to close delete or deactivate your swiftkash account easily

Conclusion

Piggyvest does allow emergency, partial, and full early withdrawals from an active Safelock if needed before maturity. Be aware of applicable fees and interest loss, and leverage the early access only as an absolute last financial resort.

After reading this blog you know about How to Withdraw Money from Piggyvest Safelock Before Due Date.