How to Become an Opay Aggregator and Agent in Nigeria 2023

If you’re looking for a lucrative offline business opportunity in Nigeria, becoming an Opay POS aggregator or agent is a great choice.

Like Moniepoint, Opay is a mobile fintech platform that offers different financial services, such as money transfers, bill payments, and mobile banking.

As an Opay aggregator or agent, you can earn a good income by facilitating these services for your customers.

In this article, I will show you how to become an Opay agent, in simple steps. So, let’s get started!

Who is an Opay Aggregator?

An Opay aggregator is an individual or organization that aggregates transactions on the Opay platform. As an aggregator, you’ll be responsible for managing and distributing Opay POS. You’ll also be responsible for handling customer complaints and providing support to Opay agents in your network.

Who is an Opay Agent?

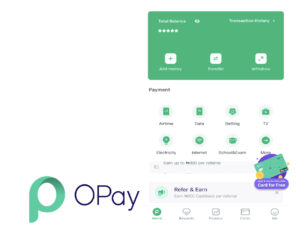

An Opay agent is an individual that provides financial services on the Opay platform. As an Opay agent, you’ll be responsible for facilitating transactions for customers in your community. This includes services such as money transfers, bill payments, and mobile banking.

Related Article: How to Start Local Dropshipping Business in Nigeria with 50k or Less

What are the requirements to Become an Opay Aggregator and Agent?

What a pernicious question.

To become an Opay aggregator or agent, you’ll need to meet the following requirements which include;

1. Have a registered business

You need to have a registered business in Nigeria to become an Opay aggregator or agent. This means having a valid business name, business registration certificate, and tax identification number (TIN). With this, you have passed the first verification stage.

2. Have a physical location

You’ll need to have a physical location for your business, such as a shop or office, where customers can visit to access your Opay services.

3. Have a smartphone

This is the third requirement. You’ll need to have a smartphone that can access the internet and download the Opay app.

4. Have a bank account

You’ll need to have a bank account in Nigeria where Opay can deposit your commissions and transaction fees. Well, you can use your Opay account as well.

5. Have a minimum startup capital

If you want to start this business, you’ll need to have a minimum startup capital of N50,000 to become an Opay agent. With this, you get your Opay terminal machine and also have some cash to process transactions.

How can you Apply to Become an Opay Aggregator and Agent?

For you to become an Opay agent or aggregator, you’ll need to follow these five simple steps:

Step 1: Visit the Opay website

The first step to becoming an Opay aggregator or agent is to visit the Opay website.

On the homepage, click on the “Create an Online Marchant account” or ” Create a POS Marchant Account” button, depending on which option you’re interested in.

Step 2: Fill out the application form

Next, you’ll need to fill out the application form with your personal and business details. This includes your full name, phone number, email address, business name, business registration number, and business location.

Step 3: Submit your application

Once you’ve completed the application form, click on the “Submit” button to send your application to Opay for review. You’ll receive an email from Opay confirming that they’ve received your application.

Step 4: Wait for approval

Opay will review your application and notify you if your application is approved. This may take at least 2 days or one week, depending on the volume of applications Opay receives.

Step 5: Start providing Opay services

Once you have your POS device, you can start providing Opay services to customers in your community.

This includes services such as money transfers, bill payments, and mobile banking. You’ll earn a commission on each transaction you process, which will be paid directly to your bank account.

Check this Also: Risevest Vs Passfolio: Which is Best for Investing in U.S Stocks Today?

An Alternate method to Apply to become Opay Agent

Alternatively, you can use this method:

- Open your Opay app directly on your phone.

- Click on your photo Icon and click on “upgrade to agent”

- You will need to provide one of the following information that includes; NIN, international passport, or Voter’s card.

- Once it’s confirmed, you will automatically be upgraded to an agent.

Benefits of Becoming an Opay Aggregator and Agent

If you become an Opay aggregator or agent, you will have access to some premium benefits such as

- Lucrative income: As an Opay aggregator or agent, you can earn a good income by just initiating financial services for customers. You’ll earn a commission on each transaction you process, and with time, you will earn and cash out big.

- Flexibility: It is a daylight truth that Opay allows you to work on your schedule. You can choose when and where to provide services, making it easy to balance work and other side hustles.

- Low startup costs: Becoming an Opay agent requires a relatively low startup cost compared to other businesses. With just N50,000, you can start providing Opay services and earn a good income.

Responsibilities of Being an Opay Aggregator

While you understand that working as an Opay Aggregator provides six figures in income, it’s important to know some of your responsibilities. Let’s kindly touch on these.

- Providing excellent customer service: You’ll need to provide excellent customer service to ensure that customers are satisfied with the services you provide. This includes handling complaints and providing support to customers when needed.

- Managing transactions: As an aggregator, you’ll be responsible for managing transactions on the Opay platform. This includes ensuring that transactions are processed smoothly and that agents are following the correct procedures.

- Recruiting and managing agents: As an aggregator, you’ll be responsible for recruiting and managing a network of Opay agents. This includes providing training and support to agents and ensuring that they’re following the correct procedures.

Frequently Asked Questions

How much does it cost to get a POS machine from OPay?

To get a POS Machine in Nigeria especially if it’s from Opay, you will need to have at least N50,000. As many claimed that it’s free, the obvious truth is that Opay POS is not free.

Can 20k start a POS business?

As an entrepreneur, 20,000 Can not start any POS business whether you’re getting from Opay or another Fintech company. I will advise you to have at least 50-100k to start the POS business.

Can I start POS business with 100000?

Yes. For a start, 100,000 Naira is more and enough to start a POS business in Nigeria.

Conclusion

Thanks for reading to this very end. That’s all about how to Become an Opay Aggregator and Agent in Nigeria without much stress. Hope you’ve learnt something unique today. Get into action and start your POS business today.